How much risk does one medical bill create for a household in the united states? This guide answers that question with clear data and practical steps.

This Ultimate Guide explains immediate and long-term financial and health impacts for working-age people and families. In 2023, 25.3 million people ages 0–64 lacked coverage, and the uninsured rate held at 9.5% (ACS/KFF).

We separate two kinds of costs: personal exposure, such as medical bills, debt, and delayed care; and system spillovers, like uncompensated care and community strain. Polling shows many cannot pay a $500 unexpected medical bill out of pocket.

Readers will learn who is most likely to be uninsured, why gaps occur, what it costs households and communities, and how to reduce risk when choosing plans. The guide uses recent ACS and KFF data so you can make informed decisions about health and health care.

Why Being Uninsured Matters for Your Financial Health

Lacking health coverage can turn a single illness into a financial emergency for a household.

What “uninsured” means today

Uninsured means no private plan, no employer plan, no Medicaid/CHIP, and no Marketplace plan when coverage is measured. It includes people with year-long gaps and those who miss short enrollment windows.

Even brief gaps can leave one event exposed to full bills. That exposure often exceeds routine savings.

How coverage shapes access, prices, and risk

Health insurance changes the consumer experience through negotiated rates, network pricing, deductibles, copays, and out-of-pocket maximums.

With coverage, routine visits and early diagnosis happen more often. Without it, adults report delaying or forgoing needed care due to cost.

Risk pooling spreads costs across many enrollees; without that pool, a single household bears full financial risk.

| Metric | Uninsured | Insured | Practical Impact |

|---|---|---|---|

| Routine visits per year | Lower | Higher | Delayed care raises later bills |

| Out-of-pocket exposure | Full billed amount | Negotiated rates + limits | Greater financial unpredictability |

| Financial risk | Household bears risk | Risk pooled among members | Predictable premium + cost-sharing |

Why this matters: Not having insurance coverage often stems from cost, eligibility rules, or enrollment friction—not simply preference. Later sections explain common drivers and ways to reduce risk.

The Cost of Being Uninsured in the United States Right Now

In 2023, 25.3 million people ages 0–64 were without health coverage. That figure represents an uninsured population whose exposure matters for household budgets and local safety nets.

Headline numbers for 2023

The national uninsured rate stood at 9.5% in 2023, statistically unchanged from 2022 but lower than 2019’s 10.9%.

Why the rate stayed historically low

Two policy forces helped. First, pandemic-era protections—including Medicaid continuous enrollment until March 31, 2023—limited immediate coverage losses. Second, enhanced Marketplace subsidies remained in place and were extended through 2025, buffering affordability problems.

What shifted beneath the surface

Although the overall population and rate were steady from 2022 to 2023, age groups moved differently. Child uninsured counts rose from 3.8 million to 4.0 million and the child rate rose from 5.1% to 5.3%.

The adult uninsured rate fell modestly, from 11.3% to 11.1% for ages 19–64. A stable national rate can mask large state and income variation.

Looking ahead: ongoing Medicaid unwinding and the 2025 subsidy timeline mean future years may show faster shifts in who remains uninsured and which share of the population faces gaps.

Who Is Most Likely to Be Uninsured

Coverage gaps are concentrated among working-age adults, and that pattern shapes household risk across the country.

Age differences matter: In 2023, adults ages 19–64 had an uninsured rate of 11.1%, compared with 5.3% for children. Child coverage is often steadier thanks to Medicaid and CHIP pathways that many states maintain.

Working families and employment

Most people without coverage live in families with work. About 73.7% have at least one full-time worker and 11.2% have a part-time worker in the household.

This shows uninsurance often stems from affordability or employer offer gaps, not unemployment.

Income and affordability

Income drives exposure. A large share—80.9%—are below 400% of the federal poverty level, and 46.6% are below 200%.

Lower income means less savings and a higher chance that medical bills push a family into debt.

Race, ethnicity, and immigration

Coverage shares differ by race: White 37.1%, Hispanic 41.1%, Black 12.5%, Asian 3.7%. These gaps reflect job types, state policy, and enrollment barriers.

Citizenship is also a strong predictor: 74.2% of uninsured are citizens and 25.8% noncitizens, with nearly one-third of noncitizens lacking coverage.

Bottom line: adults in working families with limited income, plus racial and immigration barriers, make up most uninsured people. These patterns cluster by states and region, which affects local risk and safety-net demand.

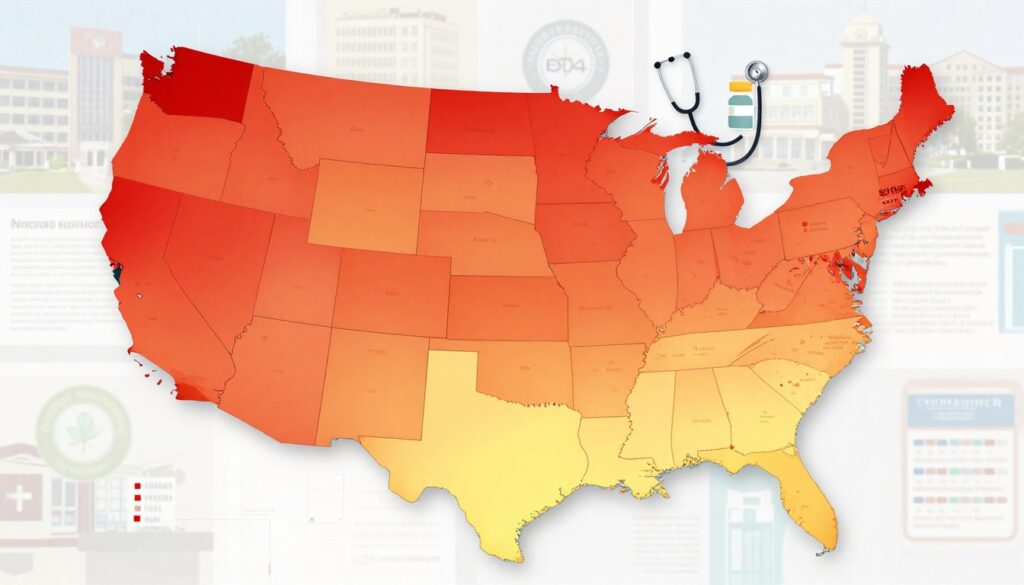

Where Uninsured Rates Are Highest: States, Regions, and Medicaid Expansion

State-level differences reshape who lacks health coverage and how deep that exposure runs.

Medicaid expansion remains a major divide. In 2023, expansion states posted a 7.6% uninsured rate, while non-expansion states saw 14.1%. That gap shows how eligibility rules matter for low-income adults and household budgets.

“It is striking how policy choices map onto coverage gaps across the country.”

About 73.9% of the uninsured population lives in the South or West. Regional patterns reflect state policy, labor markets with more low-wage work, and demographic mixes that affect eligibility and enrollment.

From 2022 to 2023, overall rates fell in FL, HI, IL, MO, ND, OR and rose in IA and ID. Child uninsured rates increased in AL, ID, NM, SC, TX, WA—small percent shifts that can mean thousands of children miss preventive care.

| Measure | Expansion states | Non-expansion states |

|---|---|---|

| Uninsured rate (2023) | 7.6% | 14.1% |

| Regional share of uninsured | 73.9% in South and West | |

| Notable 2022→2023 moves | Falls: FL, HI, IL, MO, ND, OR. Rises: IA, ID. Child rises: AL, ID, NM, SC, TX, WA | |

Practical point: where you live affects eligibility, enrollment help, and affordability. Next, we examine why people go without coverage—cost, rules, and friction drive much of this variation.

Why People Go Without Health Insurance Coverage

Affordability barriers, paperwork, and policy rules drive why millions remain without health insurance.

Price and what it means

Cost tops reasons: 63.2% of uninsured adults cite price as the main barrier. That figure covers monthly premiums, high deductibles, and fear of large out-of-pocket bills.

Eligibility limits

About 27.0% say they are not eligible. This group includes adults in Medicaid coverage gaps, people excluded by immigration rules, and those who fail affordability tests tied to employer offers.

Signup and time friction

Signing up feels too difficult for 23.9%. Complex forms, confusing plan choices, limited in-person help, and tight deadlines keep many from enrolling. Time pressures from work and caregiving make paperwork harder.

Note: nearly 14.5 million people could qualify for Medicaid or subsidized Marketplace plans but remain without coverage due to awareness, documentation, or process barriers. Another 10.9 million fall outside ACA reach because of state non-expansion, immigration status, or affordability rules.

| Reason | Share (2023) | Common barriers |

|---|---|---|

| Too expensive | 63.2% | Premiums, deductibles, out-of-pocket fear |

| Not eligible | 27.0% | Medicaid gap, immigration limits, employer tests |

| Signup difficulty | 23.9% | Forms, deadlines, limited help, time constraints |

Job-Based Insurance Coverage Gaps and Rising Premiums

Job-based plans still shape access for most people, yet missing offers and rising bills leave many families exposed.

When employers don’t offer benefits

Employer-sponsored insurance remains central in the United States. Yet in 2023, 64.7% of workers without coverage were employed by firms that do not offer benefits. That figure shows a structural gap, not a simple personal choice.

Why “offered” can still be unaffordable

An offer does not guarantee usable protection. Dependent premiums, high deductibles, and monthly charges push family budgets hard. Many households must weigh payroll deductions against other living bills and drop coverage.

Premium trends and household strain

From 2014 to 2024, total family premiums rose 52%, while workers’ share jumped 31%, outpacing wage growth. That gap squeezes pocket savings and raises the odds families will forgo insurance when money gets tight.

| Measure | Change | Practical impact |

|---|---|---|

| Family premiums | +52% | Higher monthly payments |

| Worker share | +31% | Less take-home pay |

| Wages | Lower growth | Reduced affordability |

Practical point: rising premiums and cost-sharing tie directly to broader health care costs. Insured people still face burdens, but those without coverage absorb full billed amounts and often delay care until problems worsen.

Medicaid, CHIP, and Marketplace Coverage: What’s Available in 2025

Whether a household lands in Medicaid, CHIP, or a marketplace plan hinges on income, residency, and recent policy moves. In practice, choices shape monthly bills, provider access, and available services.

How expansion changes adult access

Medicaid expansion now covers adults at higher income thresholds in 41 states plus DC. States that added expansion, including South Dakota and North Carolina in 2023, widened eligibility for low-income adults and steady services such as primary care and chronic care management.

Marketplace subsidies and why 2025 matters

Marketplace subsidies provide premium tax credits and cost reductions for qualifying incomes. Those enhanced credits remain extended through 2025, lowering monthly payments for many who buy plans off-exchange.

Why eligible people stay without coverage

About 14.5 million uninsured people in 2023 could qualify for medicaid or subsidized marketplace help but remain outside programs. Common barriers include low awareness, paperwork, language access, fluctuating income, and concerns about plan affordability.

Family dynamics and a simple roadmap

Coverage choices often involve a spouse or family member. Mixed-eligibility households must weigh an employer offer against public programs for each family member.

| Program | Who it best fits | Practical impact |

|---|---|---|

| Medicaid / CHIP | Lower income adults, children | Low/no premiums, broader services |

| Marketplace | Moderate income adults, no employer plan | Tax credits, lower premiums |

| Employer | Workers with offers | Cost shared through payroll |

Policy risk: if marketplace subsidies lapse after 2025 without new action, coverage and affordability could worsen for many households.

How Being Uninsured Limits Access to Medical Care

Many people skip routine visits when they lack coverage. In 2023, 46.6% of uninsured adults had no visit with a doctor or health professional in the past 12 months. That behavior shows access changes everyday health choices, not just when emergencies happen.

No regular place for follow-up

About 42.8% of uninsured adults report no usual source of care. Without a regular clinic or provider, treatment becomes fragmented. That leads to repeated tests, missed follow-up, and delays in diagnosis that raise later costs.

Delaying needed care because of price

Money drives avoidance. In 2023, 22.6% of uninsured adults went without needed care due to cost, and KFF polling in May 2025 found 75% under 65 skip or postpone care because of price. People ration prescriptions, ignore early symptoms, or delay tests until problems worsen.

Children face higher missed care rates

Uninsured children also fall behind: 27.4% had no doctor visit in the past year, and 9.5% missed needed care due to cost. That means fewer checkups, delayed screenings, and lost preventive services for development and vaccines.

| Measure | Uninsured adults/children | Practical effect |

|---|---|---|

| No visit in past year | Adults 46.6% / Children 27.4% | Missed routine preventive services |

| No usual source of care | Adults 42.8% | Fragmented treatment, repeat testing |

| Went without needed care | Adults 22.6% / Children 9.5% | Delayed diagnosis, worse outcomes |

Bottom line: uninsured people are less likely to get timely services. That gap increases health risk and financial exposure when care finally becomes unavoidable.

Health Consequences of Going Without Coverage

Going without health protection often means fewer checkups and more advanced illness when care finally arrives. Missing routine services reduces screening, preventive treatment, and medication monitoring. Over time, that raises the chance chronic conditions go undiagnosed or poorly managed.

Preventive care and chronic conditions

Uninsured adults are less likely to get regular screenings and follow-up. Without timely visits, hypertension, diabetes, and other chronic conditions worsen.

Delayed detection means simple problems can become complex, requiring more intensive treatment later.

Hospitalizations and treatment intensity

Evidence shows people without coverage face higher rates of avoidable hospital stays. When hospitalized, uninsured patients often receive fewer diagnostic tests and therapeutic services.

This pattern leads to more severe presentations and higher-intensity interventions when care finally happens.

What research shows about expansion

Studies reviewed by KFF link medicaid expansion to better access, affordability, and financial security. Associations include lower mortality from cancer, cardiovascular and liver disease, and improved maternal outcomes.

Careful note: direct causation is complex, but results consistently point toward improved outcomes where coverage expands.

Practical tie: worse health reduces work capacity, lowers earnings, and increases medical bills—so health consequences quickly become financial consequences for households.

Medical Bills Without Insurance: How Costs Add Up Fast

One brief hospitalization can start a chain of separate invoices that overwhelm a family’s budget. Uninsured patients often receive multiple bills for the same episode: ER care, hospital facility charges, imaging, labs, anesthesia, and specialist consults.

Typical billing pathways include emergency department visits, inpatient stays, surgical suites, radiology, and follow-up specialist services. Each provider may send its own invoice, so a single event generates several medical bills.

No negotiated rates means sticker prices apply. Without insurer contracts, providers can charge full amounts and fewer protections exist. That raises health care costs and increases out-of-pocket exposure.

Out-of-pocket exposure can skyrocket because there is no out-of-pocket maximum to stop charges. Even a short stay for appendicitis or a broken bone can produce bills for surgery, imaging, and anesthesia that together total thousands.

A realistic scenario: an appendicitis case might create separate charges for ER evaluation, CT scan, surgeon fees, hospital room, and lab work. An asthma flare could add ambulance, ER, and inhalation therapy bills.

| Pathway | Common charges | Impact |

|---|---|---|

| Emergency visit | ER fee, imaging, labs | Immediate large bills |

| Inpatient stay | Room, surgery, anesthesia | High cumulative costs |

| Specialist care | Consult, procedure fees | Separate invoices |

KFF data show roughly half of adults could not pay a $500 unexpected medical bill out of pocket. That small threshold illustrates how one unexpected bill can drain savings and push families toward collections, credit damage, or borrowing.

What follows: unpaid bills often become medical debt, affect credit scores, and force difficult financial choices. Later sections explain how debt spreads and how households can reduce risk.

Medical Debt and Financial Instability for Uninsured People

Medical debt can start with a single clinic visit and then spiral into months of missed payments and collections. Nearly half (49%) of uninsured adults say they struggle to afford health care costs. That share is far higher than for privately insured adults and signals real affordability strain for many households.

Affordability strain

Affordability means more than a high bill. For many adults, it means juggling rent, food, and a bill that can grow with interest. Low-to-moderate income people face the largest gap.

Debt burden

About 62% of uninsured adults report having health care debt, compared with 44% of insured adults. KFF finds 41% of U.S. adults carry some medical or dental debt in forms like cards, loans, or collections.

How debt spreads

Common pathways start simple and escalate:

| Pathway | Typical result | Impact |

|---|---|---|

| Credit card charges | High interest balances | Long-term payments |

| Payment plans / loans | Monthly obligations | Reduced cash flow |

| Collections / borrowing | Credit score harm | Less access to credit |

Unpaid bills can trigger a cascade: skipped care leads to worse health, which creates further costs and more debt. That cycle reduces a family’s ability to pay for basics and strains local safety-net providers who absorb unpaid charges.

Unaddressed medical debt creates lasting financial instability for people and communities.

The Hidden System-Wide Costs of Uninsurance

When many people lack coverage, local systems carry losses that change how care is delivered. These pressures affect hospitals, clinics, and public health planning alike.

Community impacts: safety-net strain and uncompensated care pressures

Uncompensated care happens when providers treat patients who cannot pay. Hospitals and clinics absorb those bills, which raises overall costs and squeezes budgets for other services.

Safety-net clinics offer essential services but have limited capacity. That creates longer waits and makes routine care harder to access for everyone in a community.

Social and economic spillovers: equity, trust, and shared destiny effects

Shared destiny matters: research frames broad access as a merit good that supports social capital. When many lack care, trust in institutions falls and equity gaps widen.

Rural areas face special risk. High unpaid bills weaken small hospitals, sometimes leading to closures and lost emergency or specialty services.

| Measure | System effect | Practical impact |

|---|---|---|

| Uncompensated care | Higher provider losses | Reduced clinic hours, higher local costs |

| Safety-net capacity | Limited appointments | Longer waits for primary care and services |

| Rural hospital stability | Financial strain | Closures reduce emergency access |

| Community trust | Weaker social capital | Lower civic engagement, equity harms |

Why it matters to you: even people with coverage can feel downstream effects through fewer local services, strained public health efforts, and higher community costs.

How to Reduce Your Risk If You’re Uninsured or Between Plans

Finding an affordable path back to health insurance requires checking programs, timing enrollment correctly, and using local resources while you wait.

Coverage pathway checklist

Step 1: Confirm medicaid or CHIP eligibility first, based on household size and income. Many of the 14.5 million people who qualify miss enrollment.

Step 2: If not eligible, compare marketplace plans next. Enhanced marketplace subsidies remain extended through 2025, which can lower monthly premiums for many.

Step 3: Review any employer offer. An offer may still be unaffordable, so compare total out-of-pocket exposure before deciding.

Timing and avoiding gaps

Open enrollment windows set regular deadlines each year. Special enrollment periods follow qualifying life events like job change, move, or family changes.

Act quickly after an event. Taking time to delay can leave you exposed to full billed amounts and higher financial risk.

Between-plans guidance and local help

For short gaps, ask employers about COBRA or ask a marketplace plan about a start date to avoid lapses.

Use federally qualified health centers and public hospital clinics for urgent care while you pursue coverage. These safety-net providers offer health care access but have limited capacity, so keep appointments brief and focused.

| Step | Why it matters | Action |

|---|---|---|

| Check medicaid/CHIP | Lowest out-of-pocket | Confirm eligibility, gather documents |

| Compare marketplace | Subsidies lower premiums | Estimate income, apply online |

| Use safety-net | Short-term access | Find local clinic, keep records |

Pro tip: keep pay stubs, ID, and immigration documents ready. Income can change during a year, so reassess eligibility if finances shift.

Goal: regain stable coverage to limit out-of-pocket exposure and restore regular access to health care.

Conclusion

Lack of coverage creates predictable financial shocks when illness or injury arrives.

In 2023, 25.3 million people ages 0–64 lacked protection and the national rate held at 9.5%. Price barriers drove many choices: 63.2% list cost as the top reason for no plan.

Limited access means fewer visits (46.6% had none last year), later diagnoses, and higher eventual health care costs. Sudden bills often become medical debt and can destabilize household budgets—49% struggle to pay and 62% report care-related debt.

Communities feel this too through strained clinics and higher uncompensated care. Act now: check eligibility, use Marketplace tools, and seek local enrollment help. With subsidies extended through 2025, reassess options each year to avoid gaps and reduce risk.